Why choose us

The Hawkish Fed and the Macroeconomic factors have taught us that there is benefit in having not only a value-based investment approach but also has shown the importance of diversification in an ever more global market where we noticed the emergence of correlations between previously uncorrelated asset classes.

What becomes the key differentiator, is using a data-driven investment and decision-making process that ensures that you are able to make the most of the current economic conditions. The right approach is necessary for the right outcome. and for us, timing the market is way more important than time in the market. We believe, that value creation and investing, need not be a guessing game, and data should be more than secondary

We offer Wealth Management Consulting and Fixed Income, Currencies & Digital Currencies Investments Strategy Consulting

What is Web 3? What is the Cryptoverse? With more than 16000 cryptocurrencies, how do you navigate the complexity? A trickle has become a torrent: the full-year totals for Venture Capital Firms for 2019, 2020 and 2021 in cryptocurrencies were $ 3.7 Billion, $ 5.5 Billion and $ 28 Billion respectively, into the infrastructure that is the protocol of the future At Kwamuka we can help you identify, your destination, and help you navigate through this new emergent ecosystem backed by data and insights from our on-chain analysis, and research teams.

Are you building a crypto portfolio and need someone knowedgeable to talk to and assit yyou in the acquisition of and selling of digital assets?With over 16 0000 digital currencies, how do you make informed decisions, how do you allocate and and track your crypto investments? At Kwamuka, we can assist you in the rationalization of the aforementioned, provisioning of skills, tools and mental models to improve the prospects of your financial returns from crypto investing, through proper diversification, risk management and asset allocation strategies. We will ensure that you are informed, up to date as well as kept abreast in this fast developing world.

Post the financial crisis of 2008, investment firms have become progressively focused on diversification from Equities and Fixed Income, Currencies, & Commodities (FICC) whilst hedging has become a Risk Management standard.A new blended investment strategy has come to prominence with VCs ploughing into this new opportunity availed by the fastest growing Asset Class by utility and adoption. As Blockchain and cryptocurrency gain more mainstream adoption amongst governments, sovereign funds and traditional funds, we are here to assist in marrying this new asset class and the existing traditional FICC investment assets to give you unbound new and lucrative investment prospects.

We are able to assist you in securing financial freedom through various international property opportunities in developed and secure property market jurisdictions. This emanated from an identified need in the Zimbabwean market for the provision of independent professional services for High Net Worth clients wishing to diversify their investments through structured portfolios in international property with the following benefits:

- Portfolio Diversification -Diversifying total investment portfolios through efficient property portfolio structuring

- High Growth Markets – We identify high-growth property markets located in secure stable and developed jurisdictions.

- Seamless Process Management – Kwamuka provides complete management of the property purchase and management process, leaving you to simply enjoy your returns.

- Established and Trustworthy Partners – Kwamuka has secured partnerships with established developers who have a proven track record within the property industry

Our Private Equity arm looks to partner with FMCG industry consumable providers on an Order Financing basis with Kwamuka controlling the end-to-end payment process whilst also providing strategic support around Business Development for the aforementioned SME’s leading to more efficient international procurement processes as well as Kwamuka assisting in Business Development leading to equity partnership agreements in some instances.

Our mission

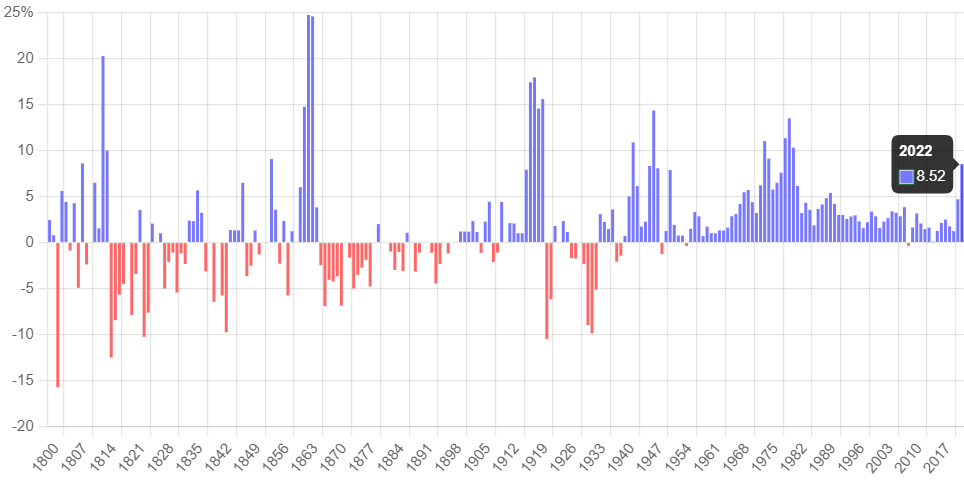

Being born out of the financial crises, our mission as Kwamuka is to take our financial future into our hands and advance wealth creation within a hyperinflationary environment that forged our acute understanding of money management, finance, and wealth preservation/creation.

The mission became ever more evident in today’s world with the current US Dollar inflation rates not seen since forty years ago. Keeping money in US Dollars within Zim is no longer sufficient, one needs to find ways to ensure at the very least you grow your investments double digits to maintain parity.